Achieving good quality CHP through the CHPQA quality mark can help organisations increase savings and avoid rising energy costs, including Climate Change Levy.

To unlock the full financial benefit of Combined Heat and Power (CHP), organisations must make sure their schemes meet the standards for ‘Good Quality CHP’ under the Combined Heat and Power Quality Assurance (CHPQA) programme.

CHP/cogeneration, which involves the simultaneous production of electricity and useful heat, is a highly efficient process that captures the heat that is normally wasted in conventional power generation. CHP can help organisations reduce their energy costs and ensure the security of their supply. It also provides a cost-effective way to make carbon savings.

CHPQA is a government initiative for assessing and certifying the quality of CHP in the UK. Originally devised in 2001, CHPQA is delivered in line with the requirements of EU Directive 2012/27/EU on Energy Efficiency and UK policy to support energy efficient cogeneration.

Under CHPQA, schemes are assessed based on their efficiency and environmental performance.

If a scheme is certified as ‘Good Quality CHP’ under CHPQA, then it will qualify for a range of financial incentives, provided that certain conditions are met.

One of the most significant incentives is a partial exemption from the Climate Change Levy (CCL), which has been charged at much higher rates since 2019. Other key financial benefits include qualification for Enhanced Capital Allowances and reduced business rates, organisations must gain CHPQA assurance to access all three of these incentives.

1. Climate Change Levy (CCL)

The CCL is a non-domestic environmental tax on electricity, gas and solid fuels. It is designed to encourage organisations to be more energy efficient. CHP schemes that qualify as ‘Good Quality’ under the annual CHPQA assessment and that consume the electricity they generate on-site are exempt from CCL payments on the gas used to generate the power and the self-generating electricity used on-site, thus achieving double savings.

2. Annual Investment Allowance

Annual Investment Allowances (AIA) encourage investment in energy saving equipment by enabling the investment to be offset against taxable profits. This replaces Enhanced Capital Allowances, which will be phased out at the end of the 2019/2020 financial year.

3. Business rates

Organisations using ‘Good Quality’ CHP to meet their on-site energy needs may benefit from preferential business rates.

Read: How Queen’s University Belfast is saving £948,000 per year with CHP technology.

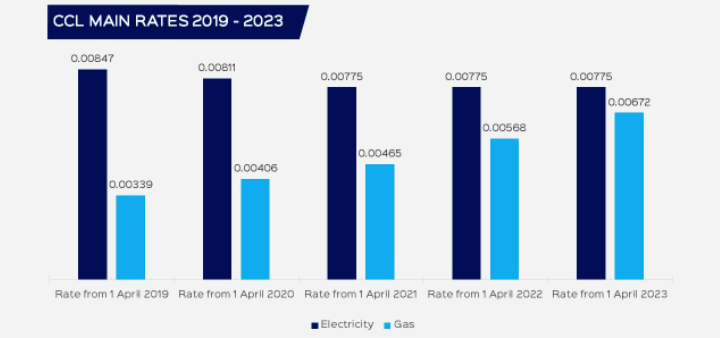

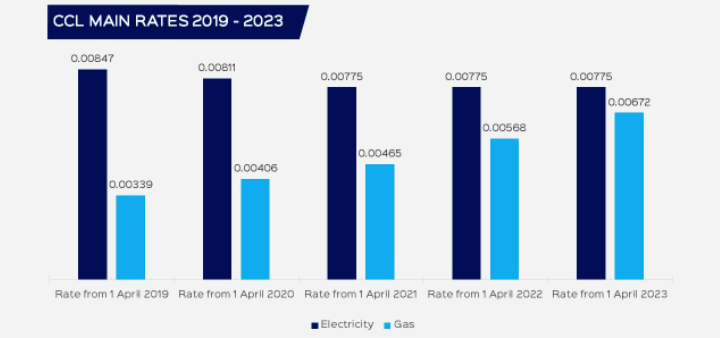

For many years the CCL rate increased only slightly year-on-year. This changed in 2019 when the government abolished the CRC Energy Efficiency Scheme (formerly known as the “Carbon Reduction Commitment”). The ‘lost’ CRC revenue has been offset by huge increases in CCL rates. In 2019 there was a 67% CCL rate increase on natural gas (from 0.203 pence per KWh to 0.339) and a 45% increase on electricity (from 0.583 pence per KWh to 0.847).

CCL on natural gas was increased by 19.7% (to £0.00406 per kWh) on 1 April 2020. Each subsequent year there will be similar double-digit percentage tariff increases through to April 2023, when the tariff will hit £0.00672 per kWh.

At the same time as the incremental increases on natural gas CCL, the tax on electricity tariffs will decrease so that, from 2023, CCL rates on gas will be equal to 87% of the rate for electricity. This makes CCL exemption on natural gas fuelled CHP systems increasingly attractive.

Light energy users and charities do not have to pay the Climate Change Levy (CCL). Some very large energy users can also gain an exemption if they negotiate a Climate Change Agreement, but most other organisations are liable for this significant tax. Making use of efficient on-site CHP provides a proven route to reducing the financial sting of this environmental tax.

For a CHP system to qualify under CHPQA as ‘Good Quality’, evidence of energy efficiency must be provided. The project needs to be more efficient, in terms of heat and power than alternative energy options. Each CHP project will be evaluated based on data that confirms the fuel used, power generated, and heat supplied.

The CHPQA Standard sets out the definitions, criteria and methodologies for the operation of the programme. It should be interpreted alongside the more detailed CHPQA Guidance Notes, which provide compliance information, along with notes on how the Standard will be interpreted by various government departments and agencies.

The CHPQA Standard is used to assess CHP schemes under two key parameters. It calculates if the proposed CHP scheme exceeds the required threshold criteria by providing the CHP with Quality Index (QI) and power efficiency ratings.

Power efficiency is the total annual power output of a scheme divided by the total annual fuel energy input. Schemes must meet a certain efficiency threshold for their installed capacity, relative to typical values for traditional production of heat and electricity.

The full list of QI indicators is included in the CHPQA Standard.

Read: How Arla Foods is using CHP to reduce carbon emissions.

The CHPQA qualification process is a desk-based, self-assessment exercise. There are several routes to completion, with the correct route determined by the complexity of the scheme and whether it is a new or existing scheme.

A scheme is defined as simple if it meets all of the following criteria:

Those responsible for simple schemes will have to follow the same basic process as complex schemes, but the forms required at each step are shorter and easier to complete. A scheme is deemed ‘complex’ if any of the following apply:

CHPQA assessment needs to be completed once each year to ensure that a scheme is still performing efficiently. Because existing schemes can look at the previous year’s performance data, there is a slightly different CHPQA process for new and existing schemes.

In order to claim the Climate Change Levy (CCL) exemption on ‘Good Quality’ CHP fuel and electricity and the Enhanced Capital Allowance on eligible capital expenditure, you must also apply for a Secretary of State CHP Certificate (SoS Certificate). This can be requested by completing the appropriate section of the CHPQA F3 or F4 submission form.

CHPQA certification is issued on a calendar year basis and all certificates expire on 31 December of the year of approval. For existing schemes, this means that organisations should compile energy data (fuel used, electricity generated and actual heat used), assess performance and complete forms shortly after the end of each calendar year.

Guidance from the Department of Business Energy and Industrial Strategy says that organisations should submit the completed forms by the end of March to allow enough time for administrators to validate the submissions and issue a new certificate in time for the Secretary of State Certificate to be maintained at the end of June deadline.

Failing to meet this deadline may mean that entitlement to the CCL exemption is removed between the beginning of the year until the new exemption certificate is issued.

As long as your site is suitable and you use an experienced supplier like Edina to specify and install your CHP system, meeting the requirements of the CHPQA programme should be straightforward.

To meet the ‘Good Quality’ CHP classification it is important to consider the following:

Make sure the CHP project is sized properly

Any new CHP scheme needs to be based on accurate energy data at the planning stage. If a CHP plant is too large it will run inefficiently and could lose money. But if a CHP is undersized then the cost and carbon savings may not be as high as expected.

Read: Edina’s guide to optimum CHP sizing.

Make CHP the lead heat generator

CHP should take precedence over boilers as the lead heat generator at all times, so you benefit from the higher efficiency.

Use metering to accurately record usage

The metering and sub metering of fuel use and heat and electricity generation enables you to better understand the efficiency of CHP. Recording systems must be up to CHPQA standards or renewing the CHP Certificate will be difficult.

Perform proactive maintenance and servicing

It’s vital you look after the system, performing all the necessary maintenance and servicing to the manufacturer’s instructions to maintain optimum efficiency.

Edina is a market-leader in the supply, installation and maintenance of Combined Heat and Power (CHP) units and the exclusive distributor of high-efficiency MWM gas engines in the UK and Ireland.

From sites across the UK and Ireland, Edina offers a full CHP service, covering the entire process from feasibility studies and energy review – all the way through to plant installation, servicing and 24/7 remote monitoring and field service engineering support.

To discuss your CHP requirements or steps to achieving CHPQA compliance, speak to a member of the Edina team today and contact us.

These Stories on Combined Heat and Power

Copyright © Edina. All Rights Reserved.