Yes. CHP is a far more energy efficient way of using a fuel source to provide both electrical power and usable heat and can protect your business from rising energy costs.

This missive explains how Combined Heat and Power can provide greater site energy savings as the cost of gas increases whilst providing some of the protection industry needs during these challenging times.

Before we talk about CHP, let’s discuss the influencing factors affecting the power price and should you require additional information, please contact Edina to discuss further.

The lifting of COVID restrictions, reopening of industry created a surge in global energy demand, and the ongoing conflict in Ukraine has intensified market volatility, resulting in unprecedented significant gas price increases.

The cost of gas has made news headlines for the past six months and its impact is also felt across the electricity market where electricity prices have also soared.

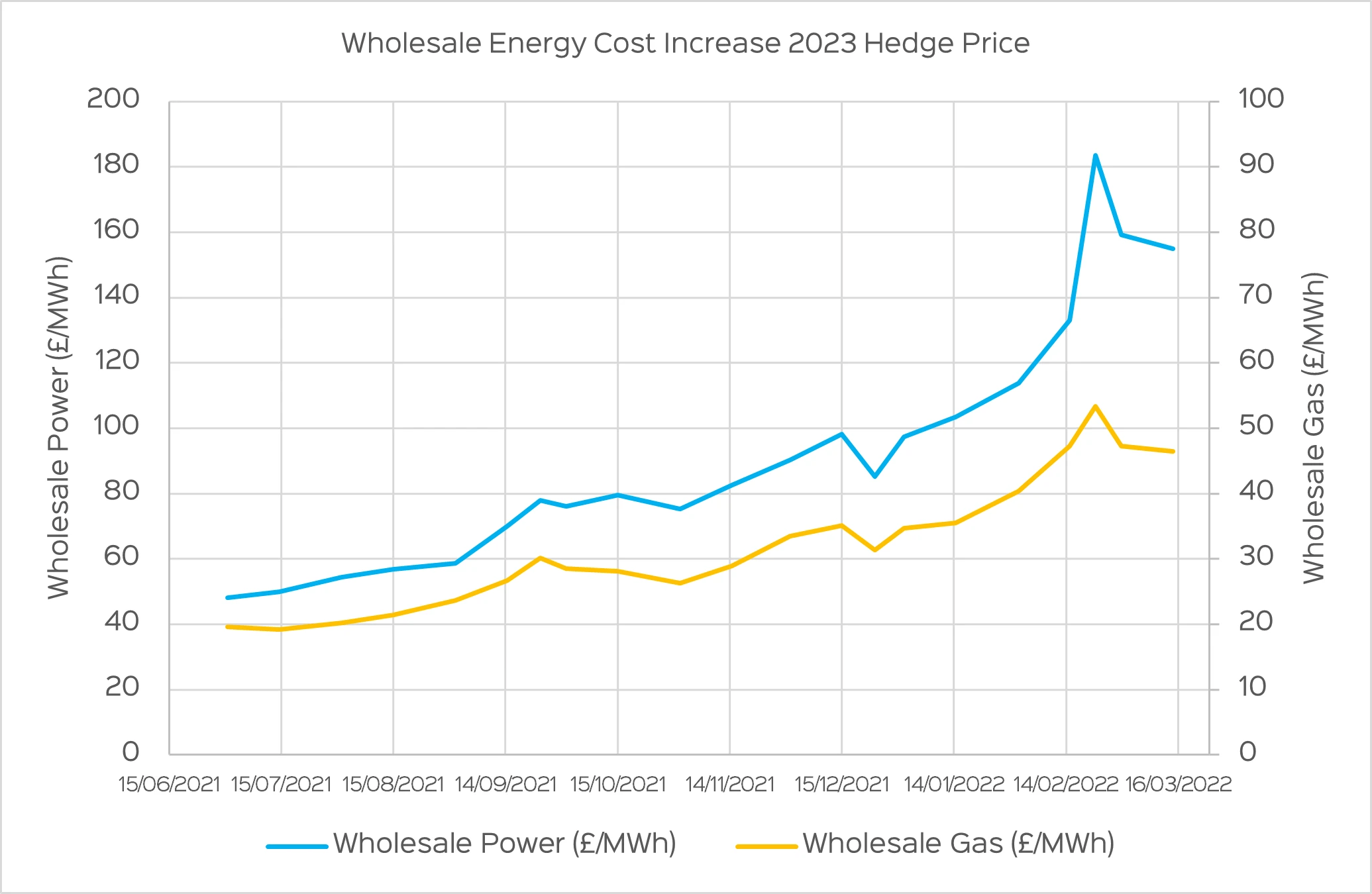

The wholesale cost of energy is the commodity cost to the UK energy suppliers before any taxes, supplier costs, government charges, and distribution costs which are added to the price that industry pays.

The UK wholesale gas price and electricity price follow each other closely because gas produces nearly 50% of UK electricity. As a nation we are dependent on gas to produce our electricity – which explains why both gas and electricity prices have soared and are likely to continue rising well into 2023 and remain elevated to at least 2025.

Understandably, these cost burdens are significant and are potentially disastrous for high energy industrial and commercial users without a fixed long-term contract or whose contract has finished.

The graph below shows the incremental wholesale gas and power price increase from July 2021. This is for energy that would be supplied in 2023 i.e. hedged. If contracted in June 2021, the same energy would cost almost three times as much if contracted just nine months later.

The immediate spot price for electricity and gas is significantly higher and more volatile. But the relationship between the gas and power costs is an almost exact similar trend.

The immediate spot price for electricity and gas is significantly higher and more volatile. But the relationship between the gas and power costs is an almost exact similar trend.

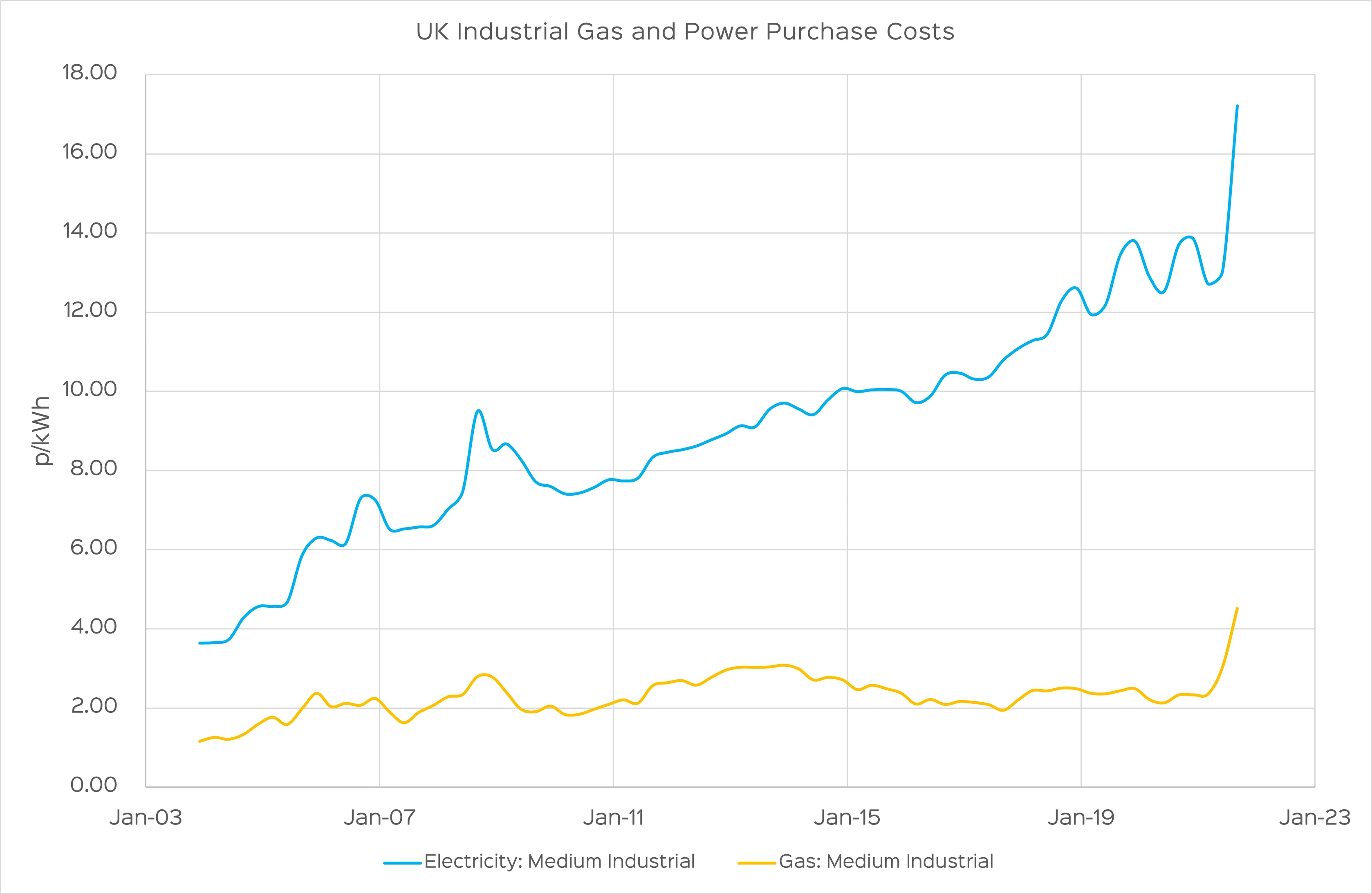

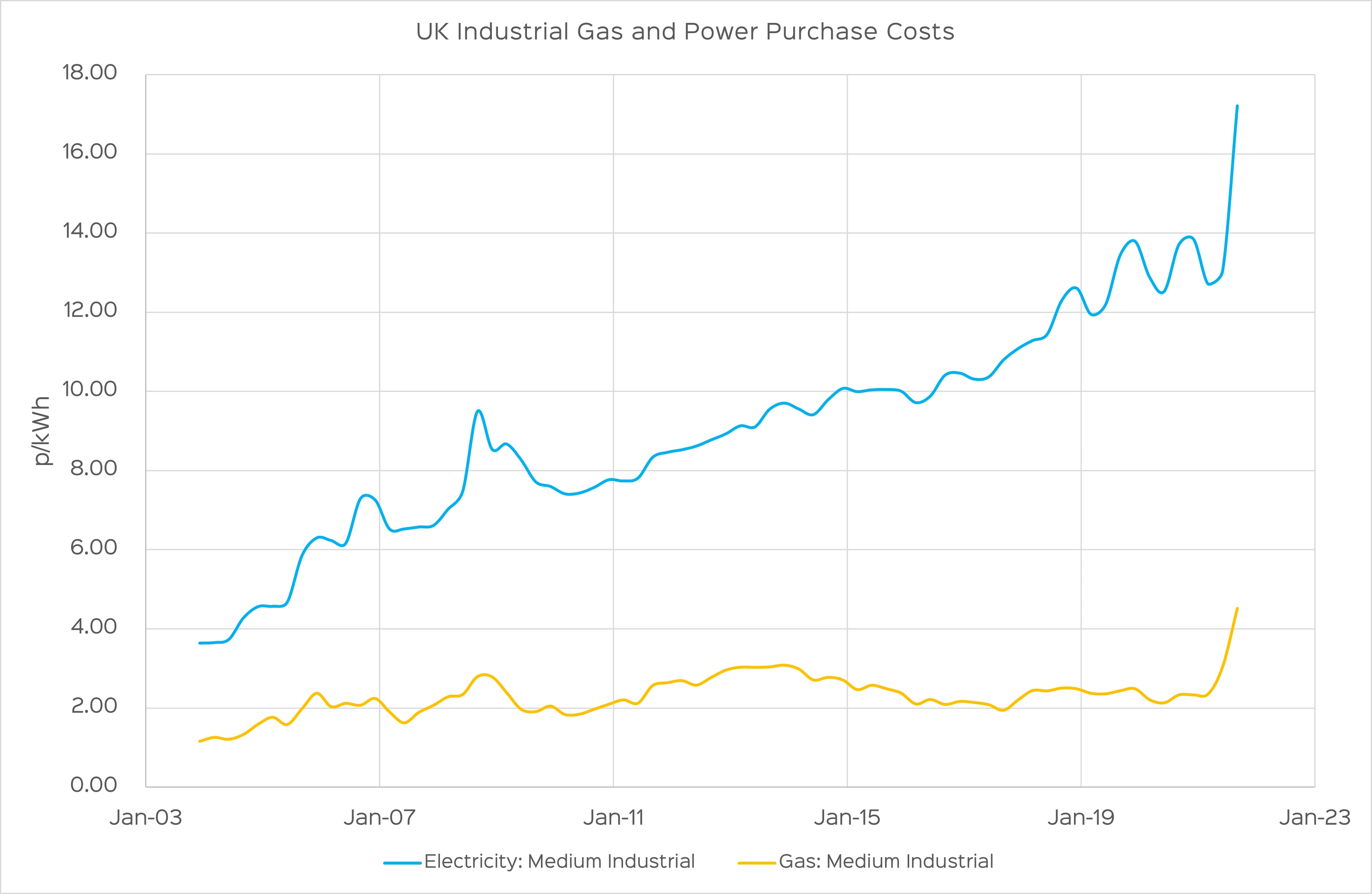

Over the past 15 years, non-domestic gas supply prices paid by industry have fluctuated between 2p/kWh and 3p/kWh, however the price of power has increased inexorably. The rise in the power price is due to the non-commodity costs associated with power supply notably the transmission and distribution costs but significantly the levies applied to pay for the de-carbonisation of the grid.

These non-commodity costs, before the current hiatus, could account for roughly 50% of an energy bill. Year-on-year from 2012 these costs have taken greater share of the energy bill. Non-commodity charges will increase annually and for high energy commercial and industrial users, operational costs may become unsustainable.

So, UK business is being subjected to not only higher gas and power costs due to the current crisis, but also, the power costs are rising even further due to the non-commodity costs.

Source - Graph based on BEIS Non-Domestic Energy pricing table (published 31/3/2022) for Medium Sized Company offtake.

Source - Graph based on BEIS Non-Domestic Energy pricing table (published 31/3/2022) for Medium Sized Company offtake.

On-site generation CHP is a means to mitigate these costs. Your business can avoid most of the non-commodity costs, but also buffer against some of the market volatility.

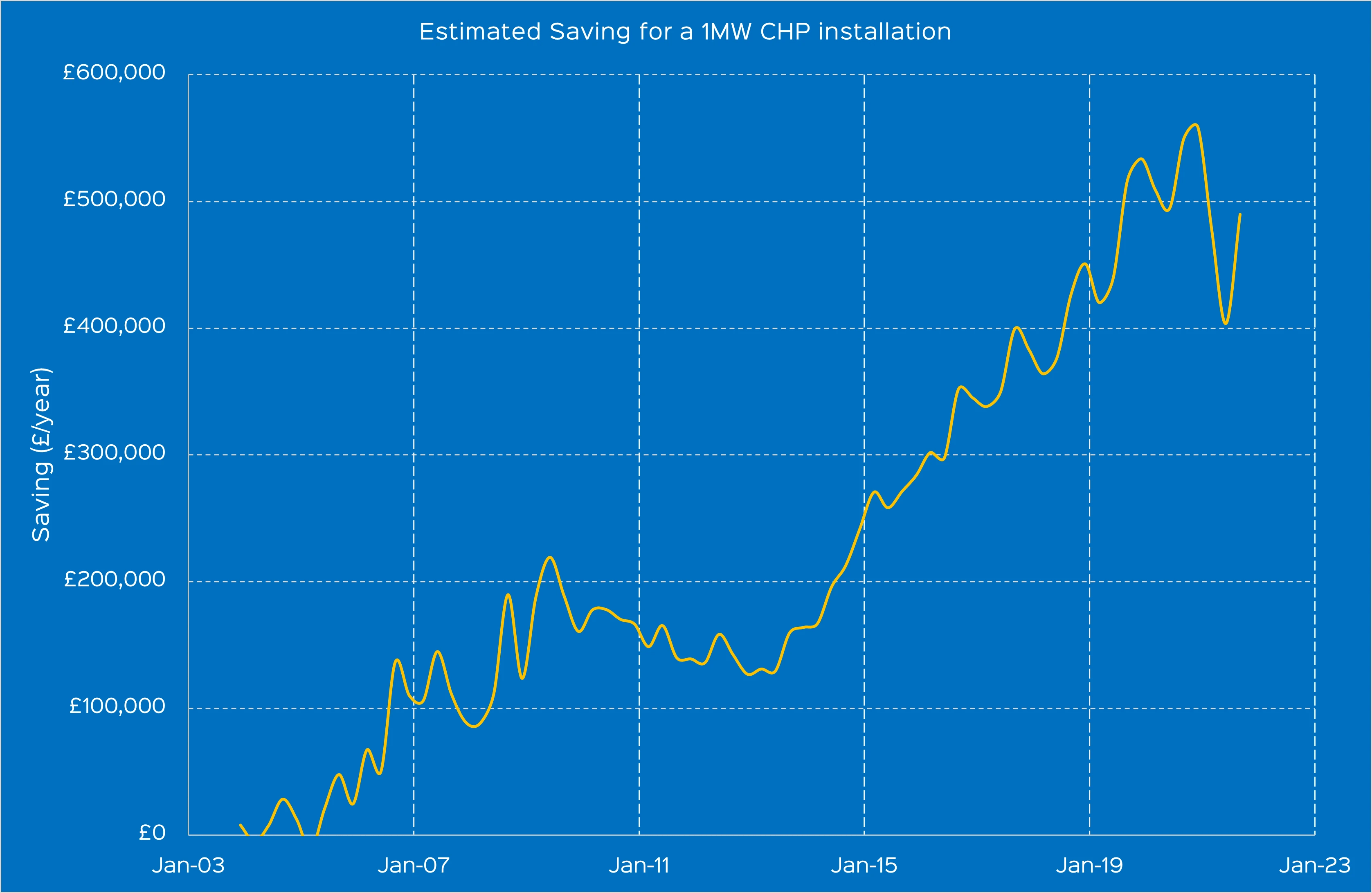

Over the past ten years, the savings available from CHP have increased. As the electricity cost increases, the savings generated from on-site CHP utilisation also increase.

Because of the link between wholesale gas and power costs, high gas costs do not affect the savings in the medium term. If gas costs rise, then the overall site energy costs also increase, and so do the potential savings from CHP provision.

These points can be demonstrated using an example installation based on a 1,000kWe natural gas operated CHP.

The example assumes the CHP plant would produce 7000MWh of electricity per year, which is fully utilised on-site displacing import electricity from the national grid. 80% of the CHP available heat is used (5600MWh/y) displacing heat generated by natural gas boilers.

This example can be used to show how the potential savings from CHP provision have increased over time. If your facility utilised CHP on-site and was paying the BEIS gas and electricity prices, then:

These savings are realised due to the relatively stable gas price and the increasing electricity price due to rising non-commodity costs.

So, power cost are on the rise. Over the past decade this increase has been due to the additional non-commodity costs and taxes placed on industrial power when there has been a historic stable gas price. Now gas prices are rising causing power costs to increase even further.

Since the wholesale gas and power prices follow each other closely, the savings from on-site CHP can be estimated from the gas price, based on the 2021 additional non-commodity costs for power.

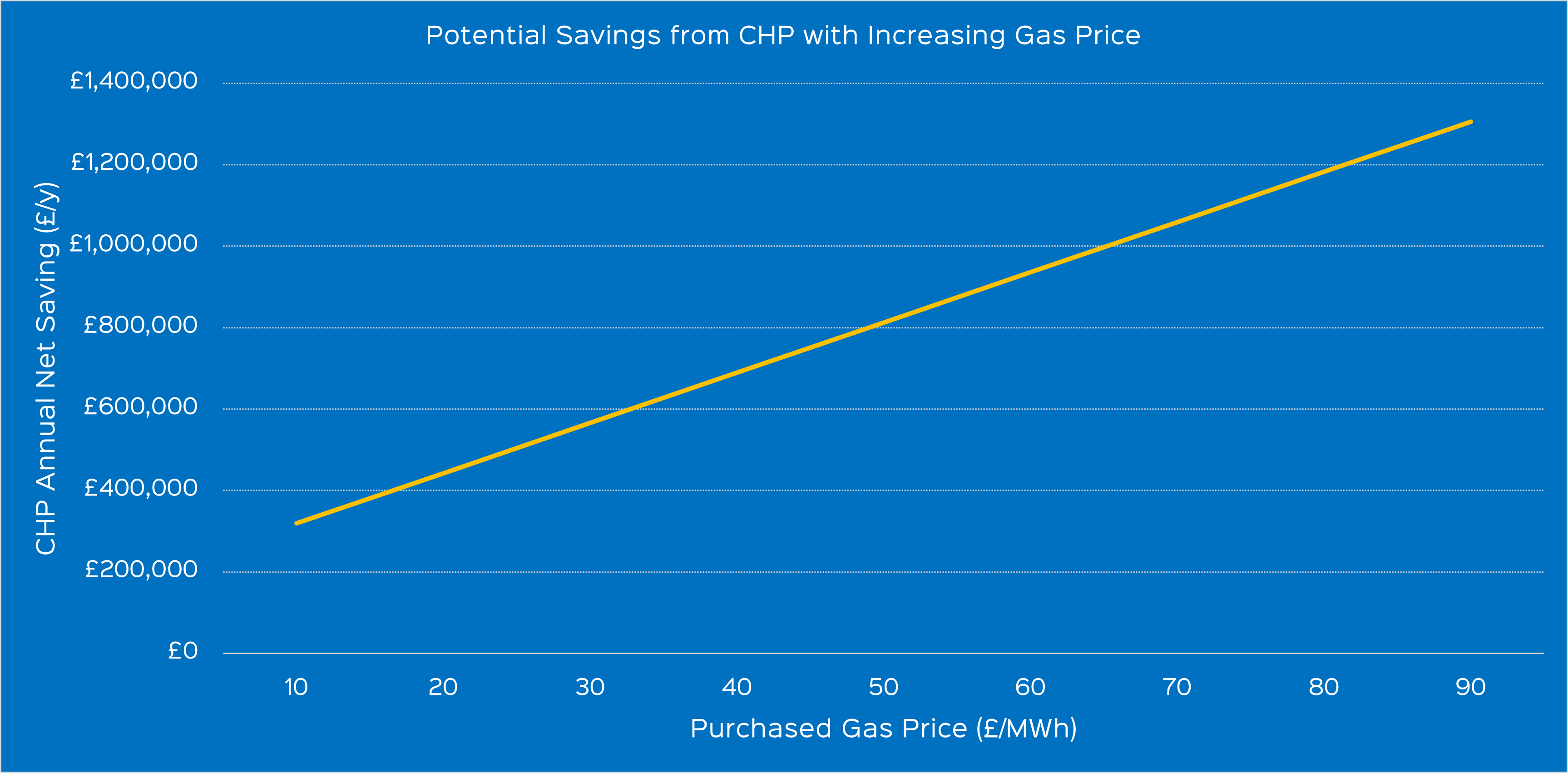

With the current volatility in gas pricing, the graph below shows what savings could be expected from a CHP (based on the CHP installation example given) against a purchased gas contract price.

In 2020, at 2p/kWh for gas, the savings would be over £500,000 per year. If the gas price rises to 4p/kWh, then the savings from CHP could be £800,000 per year.

In 2020, at 2p/kWh for gas, the savings would be over £500,000 per year. If the gas price rises to 4p/kWh, then the savings from CHP could be £800,000 per year.

CHP does not avoid your energy prices increasing but it does allow you to manage the impact. The highest benefits are realised when the maximum available energy from CHP is utilised to avoid grid electrical import and heat/cooling produced by conventional means. In other words, the greater the CHP cycle efficiency, the greater the benefit.

Edina specialises in the engineering, installation, and 24/7 asset-care support of distributed power solutions, mission-critical standby power generation, and battery energy storage solutions.

We are the official UK and Ireland distributor for MWM gas engines, a Caterpillar owned brand with over 150 years of engineering innovation within the power generation sector.

MWM gas engines operate on various low carbon, renewable fuels, and are hydrogen enabled, allowing your business to reduce its utility costs, ensuring operational resilience, and reduce emissions, as you embark on your net-zero pathway.

Our in-market operations and tier 1 distributor status ensure our teams can support your power requirements from the engineering, build, plant installation of a single gas engine or deliver the turnkey requirement of a multi configured power plant through to ongoing asset maintenance from one point of delivery.

To discuss CHP provision for your organisation, speak to a member of the Edina team today and call +44 (0)161 432 8833 or contact us.

These Stories on Press Release

Copyright © Edina. All Rights Reserved.